eDiscovery Statistics and Facts (2025)

Updated · Mar 31, 2025

TABLE OF CONTENTS

Introduction

eDiscovery Statistics: eDiscovery is a series of steps used to locate, preserve, collect, analyze, verify, and disseminate digital information. It is often used in civil and criminal court cases, as well as in government investigations. Common digital records used in eDiscovery include emails, documents, pictures, spreadsheets, audio files, websites, software programs, and other electronic files. In the past, eDiscovery tools were separate software programs mainly focused on collecting and reviewing digital data.

However, the Electronic Discovery Reference Model (EDRM) was recently created to help customers utilize eDiscovery tools more effectively. This model has also helped companies that provide eDiscovery services ensure their products work more effectively together. This article will shed more light on eDiscovery Statistics.

Editor’s Choice

- The Middle East and Africa eDiscovery market is forecasted to grow at a CAGR of over 11% from 2024 to 2030.

- The global eDiscovery market was valued at $10 billion and is predicted to grow at an annual rate of 6-9% through 2025.

- Cloud-based eDiscovery tools provide instant access from anywhere, allow for real-time collaboration and lower data storage costs.

- The U.S. eDiscovery market is set to grow at a CAGR of over 9% from 2024 to 2030.

- eDiscovery Statistics stated that Europe’s eDiscovery market is expected to expand at a CAGR of over 10% from 2024 to 2030, driven by GDPR enforcement, growing cross-border lawsuits, corporate investigations, and AI adoption.

- eDiscovery is widely used across various industries, including banking (BFSI), retail, IT and telecom, healthcare, government, legal, education, energy, and manufacturing.

Stages Of The eDiscovery Process

The Electronic Discovery Reference Model (EDRM) is a well-known diagram that outlines the different steps in the eDiscovery process.

(Source: casepoint.com)

- Identification

This is the first step, where companies look for important documents that might be useful in a legal case. In the U.S. case Zubulake v. UBS Warburg, Judge Shira Scheindlin ruled that failing to send a written legal hold when a lawsuit is expected can be seen as serious negligence. This decision made legal holds and electronic data preservation even more important.

Businesses identify who (custodians) have key information and utilize data mapping to track where files are stored. Since the amount of data can be enormous, companies attempt to narrow it down by focusing on specific dates, individuals, or topics.

- Preservation

Once a company expects legal action, it must protect relevant data. This means putting a legal hold on it so it can’t be deleted. Companies must follow proper steps to demonstrate that they have protected the data and avoid fines or penalties. If important data is lost, a court may punish the company or force it to pay the other side’s legal costs.

- Collection

After data is secured, the company gathers the necessary information and sends it to its lawyers. Some businesses use automated software to place legal holds and start collecting files as soon as they receive a legal notice. Others may need digital forensics experts to ensure that data isn’t damaged or deleted. The amount of data collected depends on how much was identified earlier.

- Processing

In this stage, files are prepared for legal review. This includes extracting text and metadata, which are hidden details about the files. To make reviewing easier, techniques such as deduplication (removing repeated files) and de-NISTing (eliminating unnecessary system files) are employed. Sometimes, files are converted into PDF or TIFF formats to facilitate labelling, editing, and the removal of sensitive details. Modern technology also utilizes AI to identify the most relevant documents rapidly.

- Review

Lawyers review the documents to identify important information and remove any content that is legally protected, such as attorney-client privilege. Special software helps organize documents by keywords, dates, or other filters, allowing lawyers to work more efficiently. Many tools also enable teams of lawyers to review cases collaboratively, thereby reducing the need for duplicate work.

- Analysis

At this point, legal teams scrutinize the data closely to identify trends, connections, or hidden details. Information is often organized into timelines or groups to make it easier to understand. For example, emails and messages can be analyzed like a social network to determine who was communicating with whom and about what.

- Production

Once the necessary documents are selected, they are sent to the opposing legal team in a format agreed upon by both parties. Sometimes, files are provided with a load file, which helps lawyers sort and review them easily. Documents can be shared in their native format or converted into PDF or TIFF format, preserving important details.

- Presentation

The last step is to show and explain the evidence in court, at hearings, or during legal interviews. The goal is to make the information easy to understand, even for people who are not experts. Companies often visualize data to make their argument clearer. The final presentation should be well-organized and easy to follow.

Top eDiscovery Tools in 2025

(Source: edrm.net)

As technology advances, eDiscovery tools have become essential for managing electronic data. Based on G2 user reviews and special features, here are the top eDiscovery tools for 2025:

- Everlaw: A user-friendly platform is known for its strong search features and visualization tools. It is popular for predictive coding and Storybuilder, making it great for complex legal cases.

- Logikcull: Known for its simplicity, Logikcull enables fast data retrieval with instant uploads and rapid processing speeds.

- Relativity: A trusted tool used by legal experts for its advanced analytics and customizable setup options.

- Epiq Discovery: Uses artificial intelligence (AI) and data analytics to simplify the review process and ensure accurate results.

- DISCO eDiscovery: A cloud-based platform that makes eDiscovery fast and easy, from data collection to document production.

- Sightline by ConsilioA cloud-based platform that makes eDiscovery fast and easy, from data collection to document production.

- Casepoint: Uses AI-driven technology like predictive coding and data analysis to make eDiscovery

smoother and more efficient. - IPRO: A versatile tool with an easy-to-use interface and strong processing power, it is suitable for cases of all sizes.

- Exterro: Provides a complete solution for legal governance, risk management, and compliance (GRC), focusing on data security and GDPR rules.

- VIP 2.0: SalvationDATA created a video evidence tool that handles video retrieval, extraction, forensic analysis, and reporting, making CCTV investigations faster and more affordable.

- Lexbe eDiscovery Platform: A high-speed tool with an intuitive design, it is perfect for team collaboration and detailed analytics.

- eDiscovery PointL Designed by Thomson Reuters, this cloud-based tool focuses on speed and simplicity, using advanced analytics to streamline legal reviews.

General eDiscovery Statistics

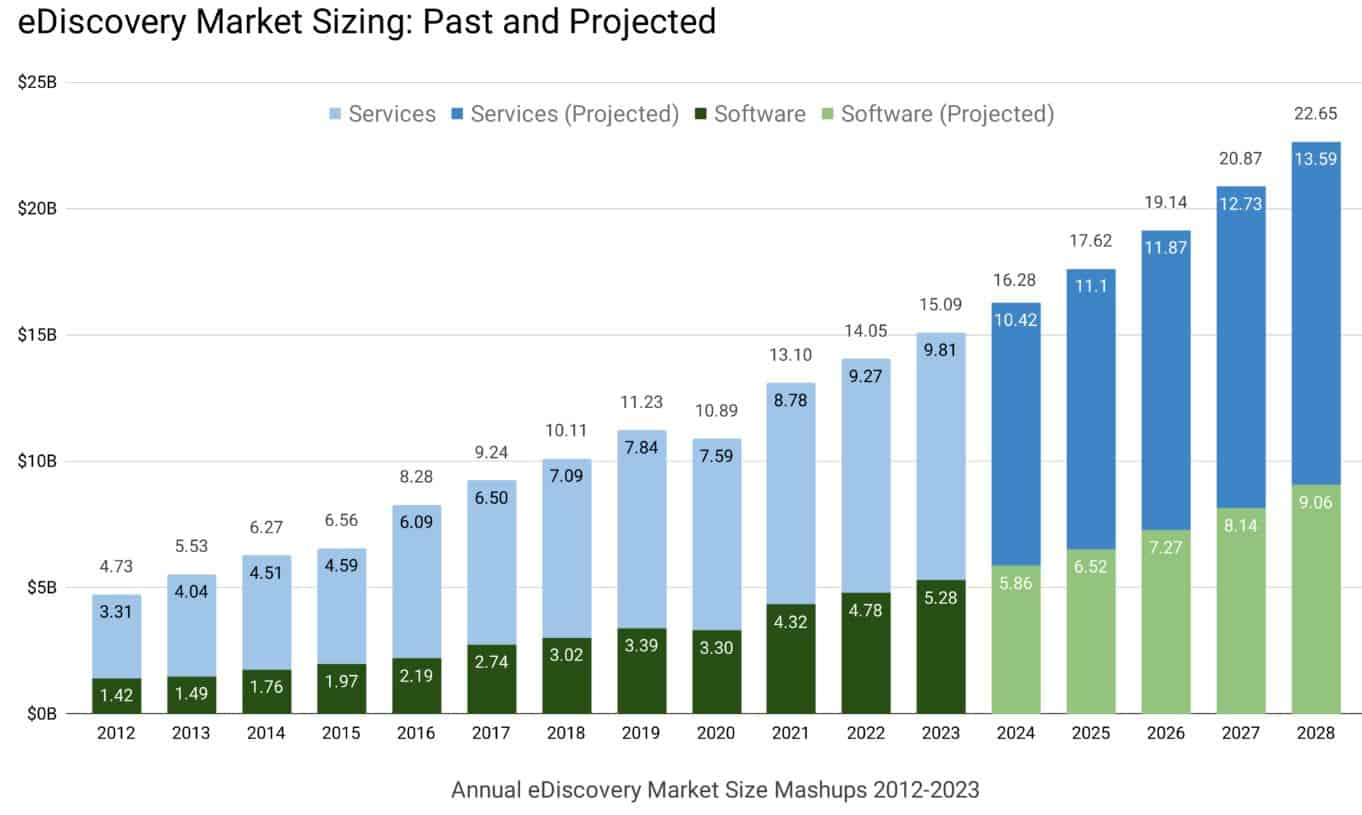

- By 2021, private sector spending on eDiscovery software and services was estimated to make up 54% of total worldwide spending, with expectations that this share would rise to nearly 59% by 2026.

- The portion of eDiscovery spending dedicated to data collection was projected to be 14% ($1.83 billion) of the total market in 2021, increasing to 19% ($3.59 billion) by 2026.

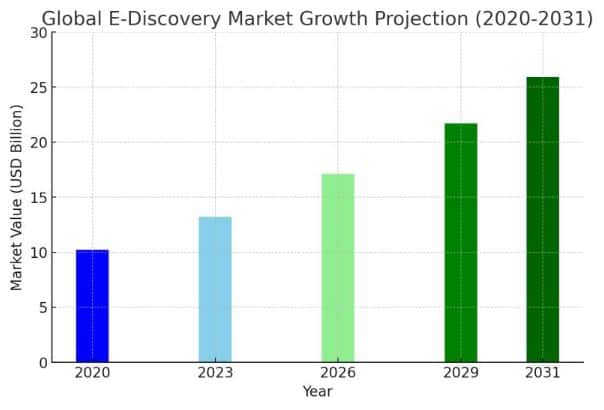

- The global eDiscovery industry was estimated to be worth $13.1 billion in 2021, with an annual growth rate (CAGR) of 7.6%, reaching $18.89 billion by 2026.

- In 2021, businesses were expected to spend $8.78 billion on eDiscovery services, making up 67% of the total market. This figure was forecasted to grow at a CAGR of 5.93%, reaching $11.71 billion (62% of the total market) by 2026.

- eDiscovery Statistics stated that 73% of legal professionals had used predictive coding tools at least a few times. This is a much higher adoption rate than usual in the legal field but not surprising at legal tech-focused events.

- At least 58% of respondents stated that they had utilized eDiscovery solutions for non-litigation purposes.

- The legal sector and courts have increasingly adopted technology-assisted review (TAR) to replace manual document review, reducing human involvement by 10% and improving efficiency and cost effectiveness.

- The global eDiscovery market was valued at $10 billion and is predicted to grow at an annual rate of 6-9% through 2025.

- eDiscovery Statistics stated that document review accounts for 73% of total eDiscovery costs, and TAR technology has proven to save time and money without compromising quality.

(Source: thebusinessresearchcompany.com)

- Research from Facts & Factors projects that the eDiscovery industry will reach $24.12 billion by 2026.

- A report from the Minnesota Journal of Law, Science & Technology estimated that an average eDiscovery case costs around $1.3 million, with 94% of expenses going toward document review and processing and just 6% allocated to collection and production.

- eDiscovery Statistics stated that producing one gigabyte of data for eDiscovery could cost $18,000, with 70% of overall costs related to document review. This placed the average case cost at about $2.3 million.

- eDiscovery Statistics stated that document review alone is responsible for more than 80% of the $42.1 billion spent annually on litigation. As data volumes grow, this percentage is expected to rise.

(Source: edrm.net)

- A report from PricewaterhouseCoopers (PwC) predicts that by 2030, artificial intelligence (AI) will add approximately $15.7 trillion to the global economy.

- An IBM study found that 59% of businesses sped up their digital transformation due to the COVID-19 pandemic, and 66% successfully overcame previous technology challenges.

- eDiscovery Statistics stated that Cyber threats have also risen sharply in recent years. Between 2016 and 2017, the number of cyber attacks increased by 60%.

- After a major cybersecurity breach, Microsoft, under CEO Satya Nadella, reported that 92% of affected servers were repaired and secured.

- The eDiscovery industry is expected to expand from $11.2 billion in 2022 to $17.1 billion by 2027, with a predicted CAGR of 8.7%.

eDiscovery Market Segmentation Statistics

Market Breakdown by Component: Services Leading the Industry

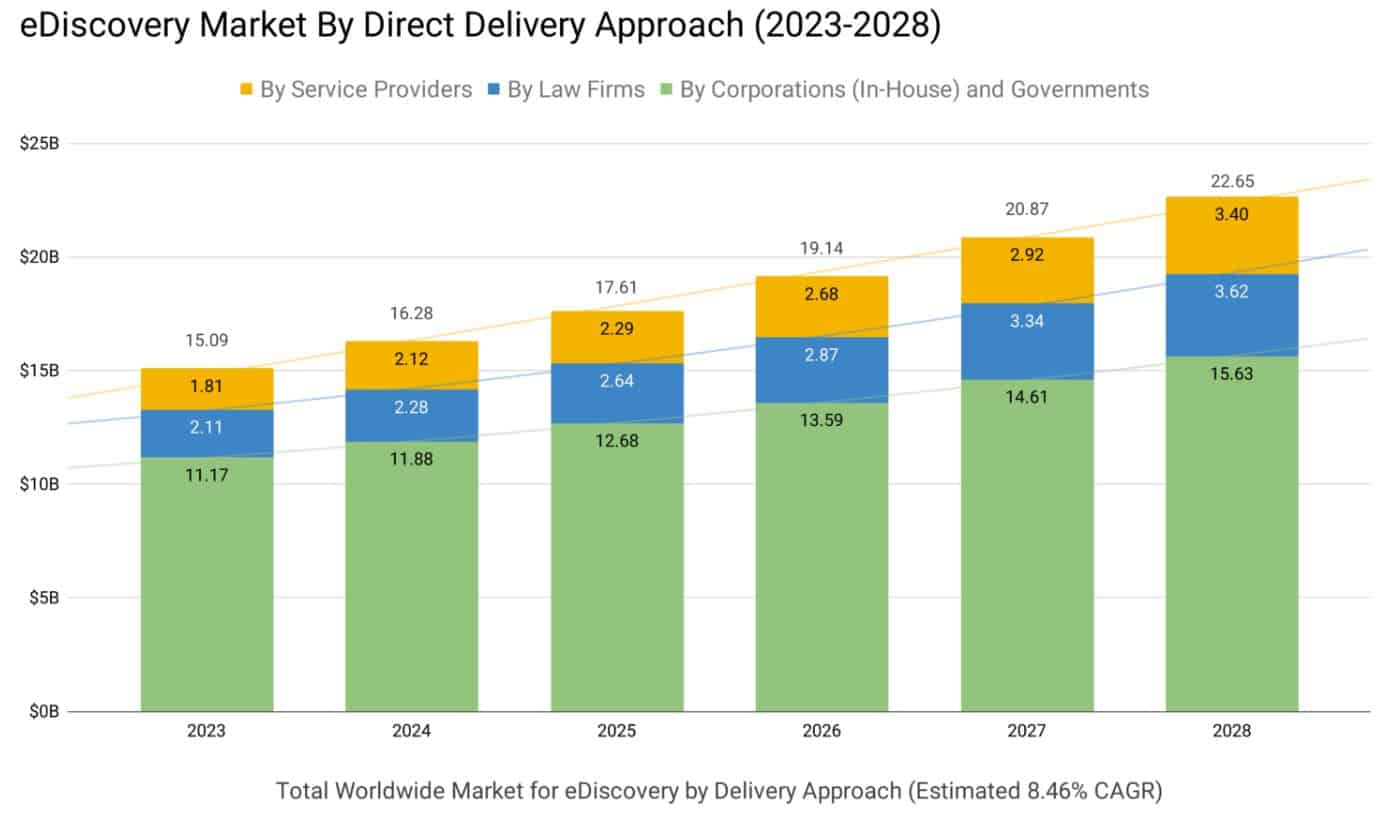

- The eDiscovery industry is divided into services and solutions. In 2024, services dominated the market as more businesses preferred outsourcing over using in-house solutions.

- Service providers handle system maintenance and technology upgrades, offering companies an all-in-one platform that simplifies operations.

- By using these services, organizations can cut expenses, prevent data leaks, and reduce legal risks.

- Because of these advantages, the demand for eDiscovery services is increasing significantly.

(Source: edrm.net)

Cloud-Based Solutions Outpacing On-Premises Models

- When looking at deployment types, the market is divided into cloud-based and on-premises systems.

- In 2024, cloud solutions held the biggest market share and are expected to expand at a high CAGR in the coming years.

- The rapid shift toward cloud computing is fueled by the rise in remote work and the convenience of a centralized system.

- eDiscovery Statistics stated that Cloud-based eDiscovery tools provide instant access from anywhere, allow for real-time collaboration and lower data storage costs.

- Additionally, AI and automation work seamlessly with cloud platforms, making them a smarter choice for businesses looking for efficiency and scalability.

(Source: skyquestt.com)

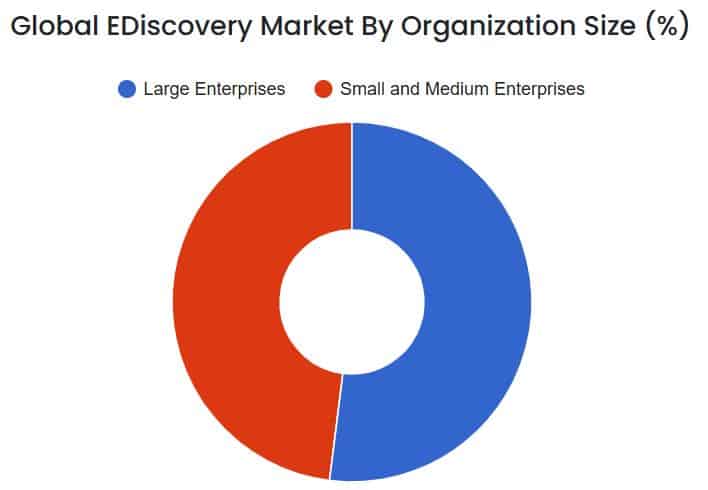

Enterprise Size: Large Companies Investing Heavily in eDiscovery

- The market is split into large enterprises and SMEs (Small & Medium-sized Enterprises).

- Large companies are expected to dominate the industry, as they are heavily investing in eDiscovery tools to manage the growing amount of digital data.

- eDiscovery Statistics stated that bigger corporations have dedicated legal teams to handle electronic records before any lawsuits arise.

- In contrast, SMEs struggle with limited legal resources, making it harder to manage eDiscovery internally.

- As major companies continue to boost spending on advanced eDiscovery technologies, market demand will rise.

(Source: fortunebusinessinsights.com)

Government & Public Sector Seeing the Fastest Growth

(Source: edrm.net)

- eDiscovery is widely used across various industries, including banking (BFSI), retail, IT and telecom, healthcare, government, legal, education, energy, and manufacturing.

- The government and public sectors are expected to grow the fastest due to the rising number of legal cases and the increasing use of AI-powered legal technologies.

- eDiscovery Statistics stated that Government agencies, including the U.S. Department of Justice’s Civil Division, use electronic records for legal investigations.

- Additionally, new product updates in this sector are fueling eDiscovery adoption.

- For instance, in March 2023, Casepoint, a leader in cloud-based legal and eDiscovery solutions, introduced an updated legal hold tool to meet the changing needs of businesses and government bodies.

eDiscovery Regional Statistics

(Source: openpr.com)

North America

- North America held the largest market share (over 47%) in 2023 due to strict data privacy laws like GDPR and CCPA, the growing number of lawsuits, and the increasing use of AI and machine learning.

- The rapid rise in digital data from different sources is also fueling market expansion.

- Companies are switching to cloud-based solutions for better scalability, using AI for automated document review and data analysis, and implementing stronger security measures to handle remote work challenges.

United States:

- The U.S. eDiscovery market is set to grow at a CAGR of over 9% from 2024 to 2030.

- The industry is shifting toward automation and data-driven legal processes, using advanced tools like Building Information Modeling (BIM) and real-time monitoring systems.

- Additionally, IoT technology is helping to improve efficiency, strengthen security, and enable remote access to legal data management.

Europe

- Europe’s eDiscovery market is expected to expand at a CAGR of over 10% from 2024 to 2030, driven by GDPR enforcement, growing cross-border lawsuits, corporate investigations, and AI adoption.

- Businesses in the region are focusing on regulatory compliance, data security improvements, and cloud-based solutions to efficiently handle legal processes.

United Kingdom

- The UK eDiscovery market is growing due to the implementation of GDPR, an increase in frequent lawsuits, and corporate investigations.

- Companies are increasingly adopting cloud-based eDiscovery software for cost-effectiveness and scalability, while AI helps improve data management and security compliance.

Germany

- In Germany, strict data protection laws, a rising need for cross-border legal compliance, and a shift toward cloud-based legal solutions are driving market growth.

- eDiscovery Statistics stated that Businesses are also focusing more on cybersecurity and data privacy to meet legal standards.

France

- eDiscovery Statistics stated that the French eDiscovery market is expanding due to the adoption of AI-driven data processing, increased cloud adoption for improved cost management, and enhanced cybersecurity measures to comply with stringent data protection laws.

Asia-Pacific

- eDiscovery Statistics stated that the Asia-Pacific eDiscovery market is expected to grow at the fastest rate, with a CAGR of over 13% from 2024 to 2030.

- New data protection laws, stricter corporate governance, rapid economic growth, and digital transformation across industries are the key drivers.

China

- The Chinese eDiscovery market is expanding due to new data privacy laws, such as the Personal Information Protection Law (PIPL), increased digitalization, and the growing adoption of AI and machine learning for legal data analysis.

- More businesses are turning to cloud-based solutions for improved scalability and cost savings while prioritizing data security and privacy.

Japan

- eDiscovery Statistics stated that the Japanese eDiscovery market is growing as businesses comply with data protection laws, such as the Act on the Protection of Personal Information (APPI).

- Companies are also adopting AI and automation for corporate governance and internal investigations.

India

- In India, new data privacy laws, such as the Personal Data Protection Bill, and rapid digital growth are boosting eDiscovery demand.

- AI and automation are being used to streamline legal processes, and the rise in corporate investigations and lawsuits is increasing the need for reliable eDiscovery tools.

Middle East & Africa

- The Middle East and Africa eDiscovery market is forecasted to grow at a CAGR of over 11% from 2024 to 2030.

- eDiscovery Statistics stated that growth is being fueled by new data protection laws in the UAE and South Africa, economic reforms, investments in advanced technology, and the need for multinational companies to comply with legal requirements.

Saudi Arabia

- With the rapid digitalization of information, the amount of electronically stored information (ESI) is increasing, resulting in a higher demand for eDiscovery solutions.

- Companies are focusing on legal and regulatory compliance, which is expected to drive market expansion in the coming years.

Key eDiscovery Company Insights Statistics

Several major companies, including Microsoft Corporation, Lighthouse, and IBM Corporation, are shaping the eDiscovery industry.

(Source: edrm.net)

Microsoft Corporation

- Microsoft is a global technology company that actively participates in the eDiscovery sector through its advanced Microsoft Purview platform.

- This tool helps businesses manage legal and compliance-related data efficiently.

- It enables organizations to discover, store, and analyze information across Microsoft services, including Exchange Online, SharePoint Online, and OneDrive for Business.

- Microsoft’s focus is on security and compliance, ensuring businesses can meet legal and regulatory obligations seamlessly.

Lighthouse

- Lighthouse specializes in eDiscovery solutions, helping organizations manage and analyze electronic data for legal and compliance needs.

- The company provides a full range of services, including data collection, processing, review, and production.

- Their platform uses AI and machine learning to improve efficiency and accuracy in handling legal data.

- Lighthouse serves law firms, corporations, and government agencies, helping them easily navigate lawsuits and regulatory investigations.

Conduent

- Conduent is a business process services company that offers legal compliance and eDiscovery solutions.

- It utilizes advanced technology and data analytics to help businesses manage complex legal processes, ensure compliance, and improve operational efficiency.

Exterro, Inc.

- Exterro specializes in eDiscovery software for legal and compliance professionals.

- Its platform helps businesses streamline data management, legal hold processes, and investigation workflows.

- By combining various tools, Exterro enables organizations to handle electronic data efficiently during lawsuits and regulatory reviews.

Conclusion

The eDiscovery market is experiencing rapid growth due to the increasing volume of digital data, stricter regulations, and advancements in AI and cloud-based technologies. North America currently holds the largest market share, while regions such as Europe, the Asia-Pacific, and the Middle East are expanding rapidly due to the implementation of strong data protection laws and the resolution of cross-border legal cases.

Leading companies, such as Microsoft, Lighthouse, and Exterro, are continually improving eDiscovery tools to make legal investigations faster and more affordable. As businesses focus more on compliance, security, and managing legal data, the demand for AI-powered, cloud-based e-discovery solutions will continue to rise, shaping the future of digital investigations. We have shed enough light on eDiscovery Statistics through this article.

FAQ.

The eDiscovery market is evolving rapidly, with an increasing number of businesses transitioning to cloud-based solutions to meet their legal and compliance requirements across multiple locations. Both public and private cloud services are now essential for managing large amounts of digital information while ensuring security, efficiency, and compliance with regulations. This shift enables companies to streamline investigations, reduce costs, and enhance teamwork, making cloud-based eDiscovery a significant trend for the future.

As we enter 2025, one thing is clear: AI is here to stay and is transforming the legal industry. The data in this report shows that law firms and legal teams that adopt AI now will lead the industry in the future. Utilizing AI-driven tools will be crucial for enhancing efficiency, accuracy, and informed decision-making in an increasingly digital legal landscape.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.